Interest Rate Swaps Explained for Dummies - Example.

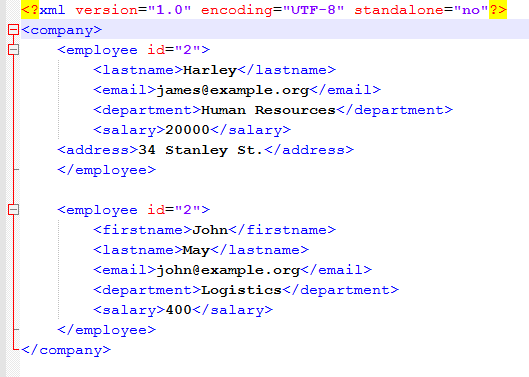

ABC will pay 6% interest at the end of each year. In this example, the interest rate is a fixed interest rate of 6% and the annual interest payment is 600,000. For other loans, the interest rate on the loan will be variable.. The vast majority of interest rate swaps have a level notional amount over the swap term. However, this is not always.Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%.The swap receives interest at a fixed rate of 5.5% for the fixed leg of swap throughout the term of swap and pays interest at a variable rate equal to Libor plus 1% for the variable leg of swap throughout the term of the swap, with semiannual settlements and interest rate reset days due each January 15 and July 15 until maturity.

For example one interest rate payment as a fixed rate and the other at a floating rate. Interest rate swaps can act as a means of switching from paying one type of interest to another, allowing an organisation to obtain less expensive loans and securing better deposit rates.Introduction. An interest rate swap is a contractual agreement between two counterparties to exchange cash flows on particular dates in the future. There are two types of legs (or series of cash flows). A fixed rate payer makes a series of fixed payments and at the outset of the swap, these cash flows are known.

Paper type: Essay Goodrich-Rabobank Interest Rate Swap In 1983, both B. F. Goodrich and Rabobank needed to execute external financing in order to raise 50 million dollars for ongoing operations. Goodrich wanted to raise the money through debt financing, but because their bonds were BBB- rated, they would have to pay a steep interest rate for a fixed rate.